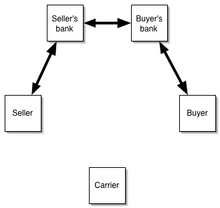

A Letter of Credit is a document issued by a financial institution,

assuring payment to a seller of goods and services provided certain

documents have been presented to the bank.

Seller provides bill of lading

to bank in exchange for payment. Seller's bank exchanges bill of lading

for payment from buyer's bank. Buyer's bank exchanges bill of lading

for payment from the buyer.

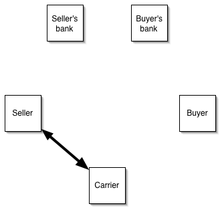

Buyer provides bill of lading to carrier and takes delivery of goods.

Hi I like Your Blog. Your blog is really informative and helpful for all. Keep updating with newer post on Personal Loan For Aditi Technologies Employees.

ReplyDeleteI really enjoyed reading this article, and found it quite informative. And especially the part about credit loans. Thanks for sharing! I generally prefer Credit Fair-e to get bad credit loans and would recommend it to all.

ReplyDeleteThat appears to be excellent however i am still not too sure that I like it. At any rate will look far more into it and decide personally! MONEY LENDER SINGAPORE

ReplyDeleteVery informative article, Which you have shared here about the letter of credit. After reading your article I got very much information about the process of letter of credit and it is very useful for us. If anyone looking for the import export data provider online, tradeimex is the best for you.

ReplyDeleteMerchants have choices in terms of machines that will help them handle credit card transactions. One example of this is the use of the wireless credit card machines. These machines work with a wireless terminal. zero rate credit card processing

ReplyDeleteVery Nice Article I like This article thank you so much for provide the right information. Import Global is the Number #1

ReplyDeleteImport Export Data

Vietnam Import Export Trade Data